how to calculate pre tax benefits

When you enrolled in the plan your employer should have given you the amount which would be deducted from your paychecks. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000.

Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits.

. Taxes affect the overall earnings of a company. For example you earn 1200 biweekly. To offer you pretax health insurance your employer must establish a plan that meets Section 125 of the Internal Revenue Code.

Subtract the value of your debt service from your NOI. When an employee pays for benefits such as health insurance with before-tax payments the. Click to follow the link and save it to your.

Go online and get a copy of IRS Circular E. Pretax earnings hence provide an. How much can pre-tax contributions reduce your taxes.

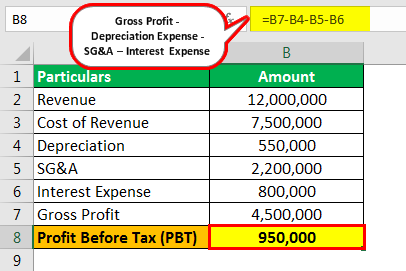

Figure federal income tax by retrieving your allowances and filing status respectively from lines 3 and 6 of your W-4 form. Health Insurance Taxable Benefit. Contrary to EBIT the PBT method accounts for the interest expense.

Provides insight into a companys financial standing. In this video well first define pre-tax financial income and review a simple approach to calculate it. This permalink creates a unique url for this online calculator with your saved information.

Income tax is calculated using the individual income tax rates Low. Therefore you pay 5040 biweekly in Social Security tax. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes.

Then find the tax. For instance on a Pre-EMI of Rs5 lakhs Rs 1 lakh will be. Significance of Pretax Income.

If you do not have a cafeteria plan the entire 1200 is subject to Social Security tax. Refer to the employees Form W-4 and the IRS tax tables for that. Some benefits can be either pre-tax or post-tax such as a pre-tax vs.

For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800. Pre-tax contributions reduce overall taxable income and provide an immediate tax-break for employees. 23000 is 6200 more than 16800.

Often the type of deduction you need to make is predefined in the policy for the. Well then calculate Coca-Colas pre-tax income for 2015 2014. This calculator provides calculations about the effect of pre-tax and post-tax contributions on your personal income tax.

Note that other pre. Its computed by getting the total sales revenue and then subtracting the cost of goods sold operating expenses and. Figure your insurance amount for each pay period.

On completion of the construction the total pre-EMI interest paid in the subsequent years is deductible in 5 equal instalments. Its advantageous to pre-tax benefits when savings on current taxes is. This is your annual net operating income NOI.

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Profit Before Tax Formula Examples How To Calculate Pbt

Are Payroll Deductions For Health Insurance Pre Tax Details More

Profit Before Tax Formula Examples How To Calculate Pbt

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

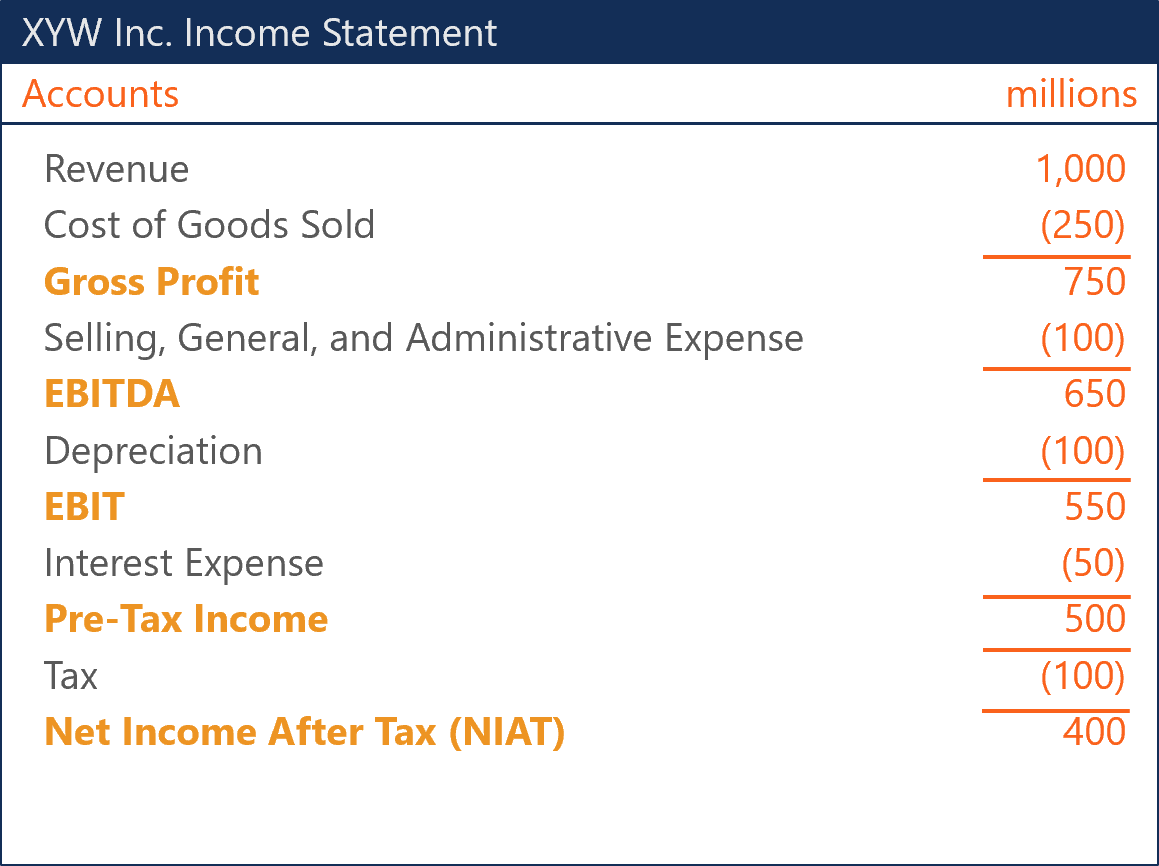

Net Income After Tax Niat Overview How To Calculate Analysis

Earnings Before Tax Ebt What This Accounting Figure Really Means

Understanding Your Paycheck Credit Com

How To Calculate Cannabis Taxes At Your Dispensary

Pretax Income Definition Formula And Example Significance

Net Operating Profit After Tax Nopat Formula And Excel Calculator

How To Calculate Gross Income Per Month The Motley Fool

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)